Sparse supply spurring more competition among motivated home buyers in Western Washington

People are moving here, home prices will continue to increase, inventory shortages will occur. That's our future. Active listings of homes and condos totaled 14,379, the lowest level since April. Compared to a year ago, last month's selection declined more than 21% and was down 10% from September. Some refer to inventory shortages as the "new normal." The sustained, lower levels of supply drive some buyers crazy as they keep expecting to gain the upper hand.

Ten counties, mostly in the Puget Sound area, have less than two months of supply of single family homes and condominiums, whereas 4-to-6 months is a level industry-watchers use as a gauge of a balanced market. With only 1.63 months of supply of single family homes (excluding condos), King County's available listing inventory is notably below the national average of four months. The report shows inventory as measured by months of supply was below King County's figure in six counties.

Condo inventory is only slightly better, at just over two months of inventory, although that could improve with several highrise projects in Seattle and Bellevue in the pipeline. We are still amid a very robust real estate market. Records show the last time the supply of homes and condos exceeded three months was February 2015, when there was just over 3.5 months of supply.

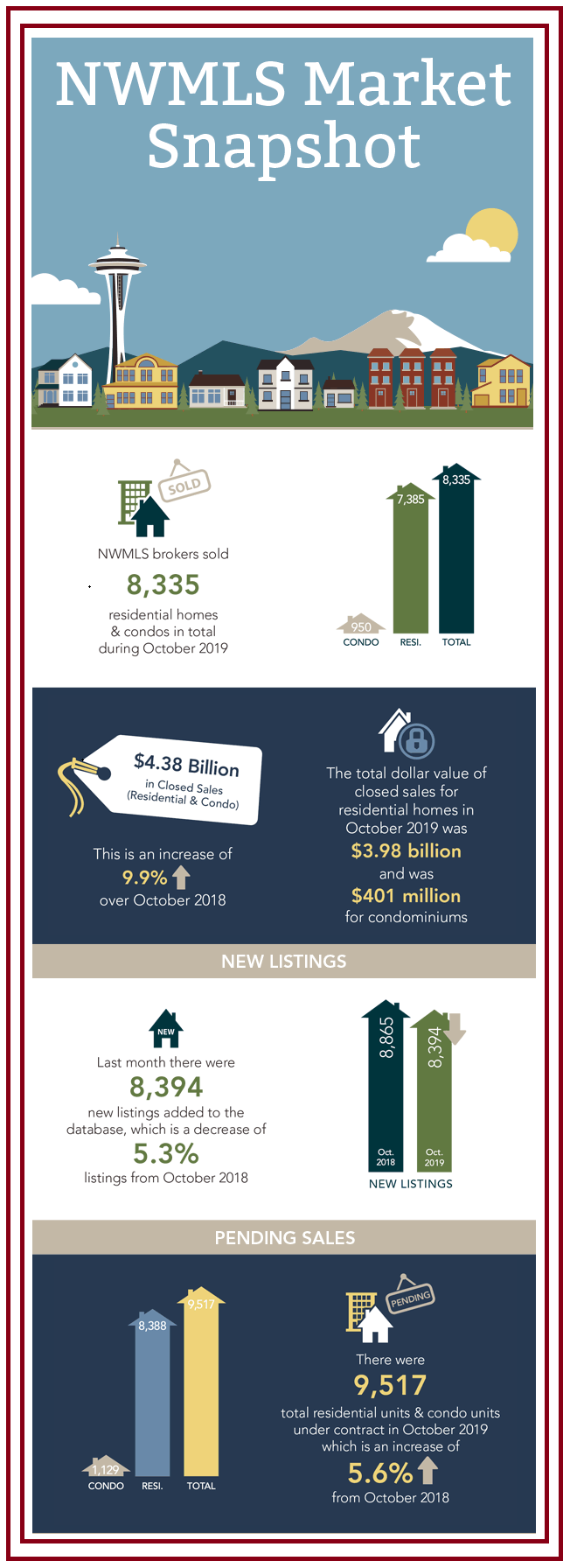

Compared to the same month a year ago, October's supply of active listings declined by double-digits in 18 of the 23 counties. Despite the slim selection, demand was strong as the volume of pending sales (9,517) outgained the number of new listings added during October (8,394). Nine counties reported double-digit jumps in pending sales compared to 12 months ago. The most recent data certainly appears to bolster the idea of a 'new normal,' as we see the same trends continuing. Inventory is staying between 1.7 and 2.3 months and median sales prices are stabilizing in many areas. Couple this with continuing positive economic news locally -- including a positive forecast for job creation, interest rates at all-time lows, and several new condo projects in the pipeline (instead of apartments) given the legislature's change this year in the construction defects laws - all these point to a new definition of a 'balanced market' of only two months of inventory instead of 4-to-6 months.

It's the season for the number of homes for sale to start dropping, and we don't expect to see a significant influx of new inventory until spring. That said, there are still plenty of buyers out there, so this drop in listings will lead to increased competition and will likely cause home price growth to increase modestly through the end of the year. Market hot spots are drawing multiple offers, fueled by the combination of moderating (or lowered) prices and strong job creation. First-time home buyers are taking advantage of many low down payment loan programs, such as state bonds, HomeReady mortgages by Fannie Mae, and other assistance from FHA, VA, and USDA (US Department of Agriculture). More flexible underwriting guidelines are also allowing first-time home buyers a better opportunity to buy. As we enter the last two months of the year, we see a pressure cooker developing in the more affordable and mid-price ranges, and we predict strong price appreciation in 2020.

With the transition to the winter market, anticipate a "clean-up" of unsold inventory when listings expire and some sellers take their homes off the market over the holidays, with plans to reposition them in the spring. Each year during the November through February time period, we see the fewest new listings come on the market, resulting in the lowest point of unsold listings occurring after the first of the year. With the backdrop of "extremely strong job growth and interest rates in the threes, the extra backlog of buyers will enter the market after the holidays, but new listings won't show up in larger numbers until March. Therefore, we predict healthy price appreciation after the first of the year.

A similar scenario exists in Kitsap County where year-over-year inventory is down nearly 27%, and come January there will be even fewer homes on the market. Both pending and closed sales are up in Kitsap County compared to last year. An end to the housing shortage is nowhere in sight. With fewer homes on the market and rising sales prices (up 12.6%) in Kitsap County, but a seasonal shrinkage of buyers, sellers are asking if it's a good time to put their home on the market. "The answer would be YES!" There are fewer active listings competing for your home, and active buyers at this time of year are serious. Strong traffic at open houses for new listings, multiple offers, and homes selling at list price with few or no seller concessions as further indicators of today's market. Cash and conventional financing are the leading methods of purchase.

In King County, for example, the median price on last month's 2,757 completed transactions was $605,000, down about 1.4% from a year ago - one of only two counties where YOY prices slipped. (Clark County reported a drop of 2.75%.) Within King County, where Northwest MLS tracks 30 sub-areas, median sales prices ranged from $371,000 (in Des Moines/Redondo Beach) to $1,892,500 (in Bellevue west of I-405). Year-over-year price changes ranged from a drop of nearly 20% (in Vashon) to a jump of more than 21% (in Bellevue west of I-405). The South Sound market is experiencing sticker shock, citing an analysis published earlier this year showing Tacoma outgained other metro areas across the nation with the fastest percentage of home equity increases since 2012. That surge may be moderating, as prices from a year ago are up more than 8.7%. Based on October figures, the median price is Pierce County, at $360,000, is more affordable than any of the nearby counties of Kitsap ($385,000), Snohomish ($475,000), and King ($605,000).

For FREE Online Home Evaluation,

please fill up the form below

Looking for Investment Properties?

Let us know what you need

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update.

OR if you would like more information on our unique systems and programs, call us at 206-391-7766 or visit our website www.GeorgeMoorhead.com

©2019. All rights reserved